In this guide we will be looking at some of the best Cryptocurrency Tax Software on the market today. If you are looking for an easy way to file your crypto taxes legally, we’ll show you which software is easy to use come tax time.

CryptoTrader.Tax

Popular crypto tax tool with automatic form generation.

CoinTracking

Long-running crypto tax tool with full international support.

Koinly

Simple tool with easy report generation and interface.

ZenLedger

Well rounded tax tool with on-demand customer service.

We will go over:

- Nine different Crypto Tax Software available to use today

- The key features in each software

- Pricing of each tool

- What exactly Crypto Tax Software is and how they work

This guide will be great for holders of cryptocurrency and also people that do sell off some investments over the year. We’ll show you the best ways to claim crypto when tax season rolls around.

Best Crypto Tax Software to Use

Our picks for the best crypto tax software are:

Next, we’ll go over each tool in more detail!

CryptoTrader.Tax

Best Crypto Tax Software in 2022

CryptoTrader.Tax is one of the most popular crypto tax tools available today. It has full international support for tax rules around the world. CryptoTrader.Tax generators a lot of different reports that you might need, including audit trails, IRS Form 8949, income report, tax loss harvesting report, and more.

CryptoTrader is very easy to use. You import your crypto history from your exchange of choice and the software will automatically establish fair market value of each coin based on historical data that it pulls on its own end. Once your history is imported, your tax report can be generated with the click of a button.

CryptoTrader is partnered with both TurboTax and TaxAct which means you can easily import your CryptoTrader report right into the tax program and it will autofill your information. CryptoTrader can be used internationally and lets you generate your reports in any currency of your choice.

Supported Exchanges and Wallets

CryptoTrader has integration from every major exchange and wallet including:

- Coinbase and Coinbase Pro

- Binance

- Uniswap

- Kraken

- Gemini

- Exodux

- BlockFi

- Crypto.com

- KuCoin

- Celcius

- Ledger

- Metamask

- Trezor

- FTX

- CoinMetro

- ProBit

Key Features

- Automatically generates you an IRS Form 8949 for attaching to your tax return.

- Direct import capabilities with TurboTax.

- Tax loss harvesting rules to help you offset and reduce your capital gains.

Pricing

CryptoTrader has 4 different pricing tiers depending on your number of trades throughout the year.

Hobbyist – $49 USD

- 100 Trades

Day Trader – $99 USD

- 1,500 Trades

High Volume – $199 USD

- 5,000 Trades

Unlimited – $299 USD

- Unlimited Trades

Use the code CRYPTOTAX10 at check out to receive 10% off your plan!

Click here to check out CryptoTrader.Tax today.

CoinTracking

Best International Support

CoinTracking is an all In one tool that was one of the first Crypto Tax software tools. It is an all in one tool with full analysis, automatic trade importing, and sophisticated tax declaration. CoinTracking has support for 13 different tax methods such as first-in-first-out, last-in-first-out, average cost, and others.

CoinTracking offers easy transaction import from over 110 different crypto exchanges and allows you to export files in many different formats such as PDF, Excel and CSV. CoinTracking also has crypto tax laws for over 100 different countries built in so that it is customized exactly for you.

CoinTracking provides tax reports for 100+ counties and also provides you history for all 18,177 crypto coins. You can even import information from obsolete exchanges, wallets, and crypto coins. You can always see the latest prices for every coin and also filter coins by volume of trades and more!

Supported Exchanges and Wallets

CoinTracking has full integrations with hundreds of wallets and exchanges including:

- ACX

- Bison

- Bitpanda

- Coinbase and Coinbase Pro

- Celsius Network

- CoinSpot

- Gemini

- HitBTC

- HotBit

- Huobi

- KCoin

- Tidex

- Zerion

- Exodus

- Ledger

Key Features

- Good value – 200 transactions for free!

- Full API support and coin importing.

- Crypto tax tracking for over 18,000 coins.

- 13 years of historical data to pull trends and information from.

Pricing

CoinTracking currently has 4 different pricing tiers available.

Free

- Available for new crypto investors and up to 200 transactions

- Very limited in terms of forms and tools available

Pro – $10.99 USD per month, billed yearly

- Up to 3,500 transactions

- 20 MB per CSV file

- Access to advanced tools and API access to your portfolio

Expert – Starts at $16.99 USD per month, billed yearly

- Different options of 20,000 / 50,000 / 100,000 transactions and the price increases with each

- Full integration with 10 auto imports for each coin and unlimited manual imports

Unlimited – $54.99 USD per month, billed yearly

- Unlimited transactions

- Full integration and access to all advanced tools

- Priority calculations and customer support

If you use our affiliate link below, you get 10% off on your plan!

Click here to view CoinTracking.

Koinly

Simplest Crypto Tax Tool

Koinly helps you generate your crypto tax summary in less than 20 minutes. It simplifes the process by connecting directly to the most popular crypto exchanges and generating your trading report. You do not need to manually export CSV files and other information.

Koinly has a slick, easy to use dashboard. It allows you to easily import your transaction history from over 350 exchanges. You also don’t have to worry about going back and forth between multiple wallets or accounts you may have. Koinly will keep all of your trading activity in one dashboard screen.

Koinly has a built in system that is meant to find any problems with your transactions and help you fix them. It will automatically skip over duplicate transactions and will also let you know if your transaction history is skewed or missing information.

Koinly is available in many different counties across the world and will generate your capital gains report based on your local tax law.

Supported Exchanges and Wallets

Koinly has integration with the following wallets and exchanges (plus more not listed!):

- Binance

- Bittrex

- Coinbase and Coinbase Pro

- Cobinhood

- Luxor

- Phemex

- Bitpanda

- CoinJar

- Celcius

- Airswap

- Metamask

- Phantom

- Divi

- Ledger

Key Features

- Connects directly to your crypto exchanges for live tax reporting.

- View your capital gains or capital losses whener you want for free.

- Integrates with TurboTax and automatically generates your Form 8949.

Pricing

Koinly has 4 different pricing tiers depending on what you are looking for.

Free – $0

- 10,000 transactions

- No access to certain tax forms (Form 8949 and Schedule D)

- No access to international tax reports

- No comprehensive audit report

Newbie – $49 USD/tax year

- 100 transactions

- Full access to everything except dedicated Email Support

Hodler – $99 USD/tax year

- 1,000 transactions

- Full access to everything except dedicated Email Support

Trader – $179 USD/tax year

- 10,000+ transactions

- Full access to all features

- Full dedicated email support

Click here to check out Koinly.

ZenLedger

Best Tax Tips and Suggestions

ZenLedger promises to simplify crypto taxes for you at tax time. All of your transactions are summarized into a unified spreadsheet.

ZenLedger has a Tax-Loss tool integrated into the software which will analyze your trading history and give you suggestions on ways to save on taxes prior to the tax deadline each year.

Once your transaction history is imported, ZenLedger will automatically calculate your capital gains and losses and compile it all onto a Schedule D form. This is needed each tax year and you can easily print off when filing your own taxes, or provide it to your accountant.

ZenLedger is only available to use in the United States right now, but they do have plans in the future to expand into the Canadian tax market.

Supported Exchanges and Wallets

ZenLedger has direct integration with over 400 exchanges and 40 blockchains including:

- Cash App

- CoinSwitch

- Coinbase and Coinbase Pro

- Bitstamp

- Binance

- Uniswap

- Zapper

- Exodus

- Ledger

- Trezor

- MyEtherWallet

Key Features

- Full tax-loss harvesting tool that automatically gives you tax saving opportunities

- Direct integration with TurboTax

- On-demand customer service 7 days a week

Pricing

ZenLedger has 4 pricing tiers available.

Free – $0

- Free software available that anyone who does 25 transactions or less in a year

- No access to DeFi, Staking or NFTs – solely crypto transactions

Starter – $49 USD/year

- Up to 100 transactions per year

- No access to DeFi, Staking or NFTs

Premium – $149 USD/year

- Up to $5,000 transactions per year

- Full access to all features

Executive – $399 USD/year

- Unlimited transactions per year

- Full access to all features

Click here to check out ZenLedger.

TokenTax

Best Crypto Exchange Support

TokenTax is a custom-built crypto tax software platform. It completely everything for you including tax calculations, capital gains calculations, and automatic tax form generation.

Just like Koinly above, TokenTax connect to every crypto exchange so that you don’t have to manually export your data. TokenTax will fully import all of your transaction data into the software and generate tax forms in minutes.

TokenTax has what they call a “Tax Loss Harvesting” dashboard where they will run your data and show you exactly where unrealized gains and losses are. They will also give recommendations on selling off certain assets in order to possibly reduce taxable gains.

TokenTax supports every single country and currency which means it will generate your reports in any currency of your choice.

Supported Exchanges and Wallets

They have full integration with every single crypto exchange so list a few of the unique ones below:

- Abra

- Ampleforth

- Binance and Binance.US

- Bitpay

- Blockfolio

- Cash App

- Coinbase and Coinbase Pro

- Crypto.com

- Compound

- Exodus

Key Features

- Connects to nearly every crypto exchange, even more obscure ones.

- Contains a detailed tax loss harvesting dashboard.

- Supports international tax laws in USA, UK, Canada, Australia, Japan, Sweden, South Africa, and more.

Pricing

TokenTax has 4 different pricing tiers.

Basic – $65 USD/tax year

- Only available for Coinbase and Coinbase Pro

- Up to 500 transactions

Premium – $199 USD/tax year

- Support for every exchange

- Up to 5,000 transactions

- Tax loss harvesting dashboard included

Pro – $799 USD/tax year

- Up to 20,000 transactions

- All exchanges supported along with DeFi and NFT integration

- Unlimited revisions and live chat support

VIP – $3,500 USD/tax year

- Up to 30,000 transactions

- Provides two 30 minute sessions with a tax expert

- Full support and IRS audit assistance

Accointing

Best Accounting Insights

Accointing is a crypto tax tool that allows you to track your portfolio and report your taxes all by yourself. Within the tool are a bunch of accounting insights which are tailored to you. As well, Accointing can connect you directly with tax advisors who can help you file your taxes.

Accointing easily imports all of your crypto transaction history and it only takes 5 clicks to generate your personal tax report for your country. They also offer both a mobile app and desktop crypto tracker to analyze your crypto transactions.

Included in the Accointing crypto tax software dashboard is an overall crypto market review in which you can set alerts for certain coins. It will also advise you of any trending crypto tokens.

Supported Exchanges and Wallets

Accointing is integrated with many exchanges, wallets and blockchains such as:

- Airbitz

- Atomic Wallet

- Binance

- Bitcoin Cash & Bitcoin

- Bitpanda

- Coinbase and Coinbase Pro

- Dash

- Deribit

- Freewallet

- Exodus

Key Features

- Has the Accointing Crypto Tax Advisor Network (ACTAN) to help you file your taxes.

- Offers you valuable insights, market trends, and tips for filing your taxes with cryptocurrency

- Has a desktop and a mobile app.

Pricing

Accointing has 3 pricing tiers available.

Hobbyist – $79 USD/tax year

- Up to 500 transactions

- Full access to all features

Trader – $199 USD/tax year

- Up to 5,000 transactions

- Full access to all features

Pro – $299 USD/tax year

- Up to 50,000 transactions

- Full access to all features

Click here to view Accointing.

BearTax

Best Crypto Tax Tool For High Volume Traders

BearTax is a robust tool for high volume traders that can crunch millions of transactions per minute. We really like the interface, which highlights your trades and cost-basis on all of your transactions.

Much like the other crypto tax software, BearTax will easily import all of your crypto transactions into one slick dashboard. BearTax will keep a history of all of your trades as well as keep a history of the cost-basis so that you can see fluctuation throughout the year.

BearTax has support through US, Canada, Australia and India. When you sign up for an account, you can choose your country and all of your countries tax rules will get auto-assigned to your reports.

BearTax will provide a full audit trail file in case you get selected by your local revenue agency to be audited. This file will give you a full report of your funds so you don’t have to worry. BearTax is integrated with over 50 exchanges via API and CSV and if your exchange isn’t supported, they will also let you do custom imports.

Supported Exchanges

BearTax has integration with:

- Binance

- Coinbase and Coinbase Pro

- Gemini

- KuCoin

- Kraken

- Coinsquare

- Circle

- Crypto.com

- CoinEx

Key Features

- Has a smart matching algorithm which flags transactions that hurt you on your taxes.

- Autogenerates all of your tax documents.

- Has privacy sessions available with professional accountants around the world.

Pricing

BearTax has 4 different pricing tiers available.

Basic – $10 USD/tax year

- Up to 20 transactions

- Unlimited exchanges

Intermediate – $45 USD/tax year

- Up to 200 transactions

- Unlimited exchanges and email support

Expert – $85 USD/tax year

- Up to 1,000 transactions

- Unlimited exchanges

- Chat support

- Multiple exchange accounts

Professional – $200 USD/tax year

- Unlimited transactions and exchanges

- Priority 24/7 chat support

- Custom file imports available

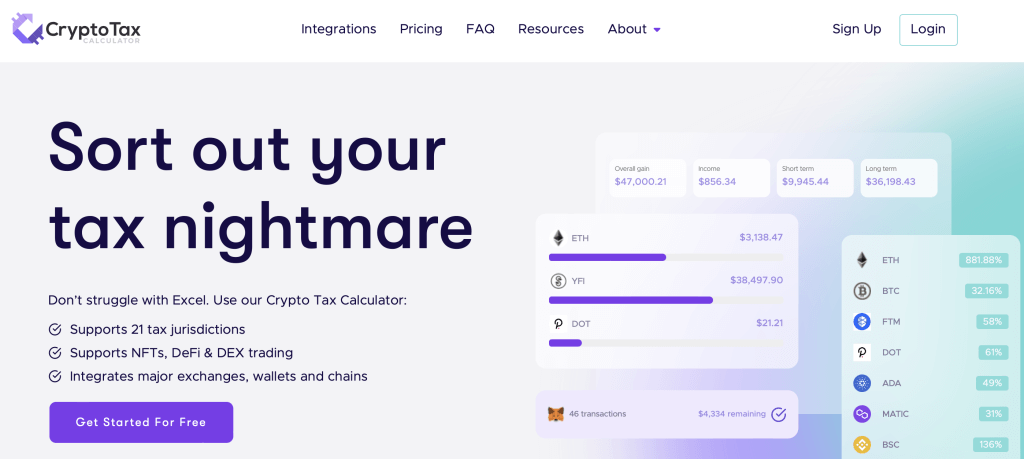

CryptoTax Calculator

Best Tax Calculator for NFTs, DeFi & DEX Trading

CryptoTax Calculator simplifies your work as long as you live in one of its 21 supported tax jurisdictions. The tool really focuses on its support for NFTs, DeFi, and DEX trading.

Along with importing your basic crypto transactions, CryptoTax Calculator also allows for more complex tax scenarios such as DeFi loans, crypto staking rewards, gas fees and more. They are fully integrated with DeFi products such as UniSwap, PancakeSwap and SushiSwap.

CryptoTax Calculator provides a breakdown of each calculation done for your taxes so that you can understand exactly what has been done. CryptoTax Calculator is supported in Australia, Canada, UK, USA, South Africa, Austria, Belgium, Germany, Spain, Finland, France, Greece, Ireland, Italy, Japan, Netherlands, Norway, New Zealand, Portugal, Sweden and Singapore.

Supported Exchanges

They are fully integrated with hundreds of exchanges and wallets such as:

- BitMEX

- Crypto.com

- KuCoin

Coinbase and Coinbase Pro - FTX

- HitBTC

- Huobi

- Ledger

- Trezor

Key Features

- Provides an easy breakdown so that you can understand exactly what has been done.

- Complete support for DeFi and DEX trading.

- You can calculate your crypto taxes as far back as 2013.

Pricing

CryptoTax Calculator has 4 different pricing tiers available.

Rookie – $49 USD/year

- 100 transactions

- Unlimited integrations

Hobbyist – $99 USD/year

- 1,000 transactions

- Unlimited integrations

Investor – $189 USD/year

- 10,000 transactions

- Unlimited integrations

Trader – $299 USD/year

- 100,000 transactions

- Unlimited integrations

Click here to view CryptoTax Calculator.

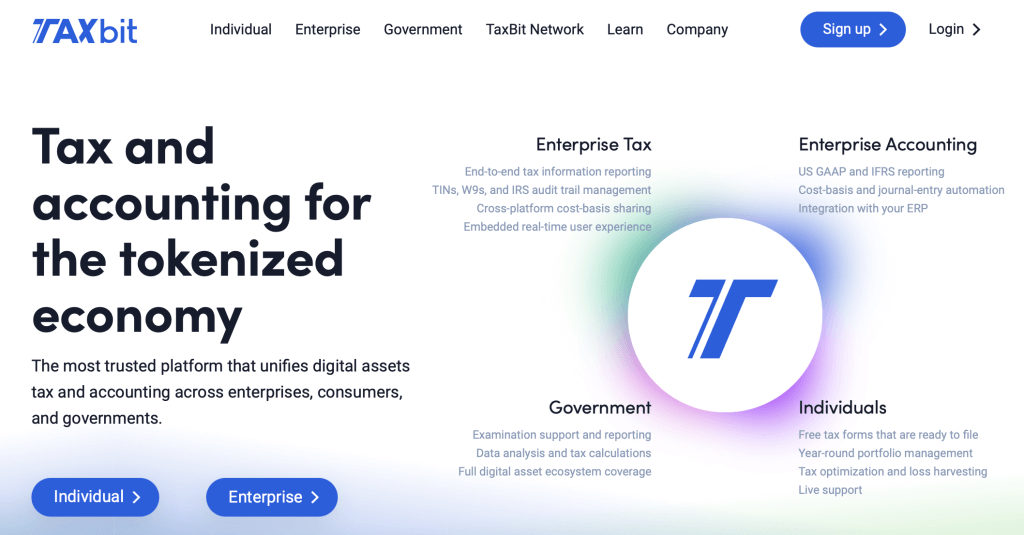

TaxBit

Best Pre-Transaction Tax Analysis Tool

TaxBit is a crypto tax software created by a team of CPAs, all with a love for cryptocurrency. This ensures that all of your best interests are being looked after when it comes to tax season. TaxBit allows you to download all of your completed tax forms for free.

This tool has API integration with all major crypto exchanges. It has been built from the ground up by CPAs who worked directly with local regulatory agencies.

With the higher up plans, TaxBit will also show you the tax impact of each trade before you actually make it. They will give recommendations so that you are getting the most out of your assets when it comes to filing your taxes. You can also monitor your investments at all times and see its performance on returns and much more.

Supported Exchanges and Wallets

TaxBit is integrated with hundreds of exchanges and wallets including:

- PayPal

- Binance

- UniSwap

- Celcius

- SoFi

- Nifty Gateway

- Coinbase and Coinbase Pro

- Okcoin

- Blockchain.com

Key Features

- Shows you pro-active value calculations before you make any trades.

- Automatic tax form generation.

- Supported by a team of real CPAs and tax professionals.

Pricing

TaxBit currently has 4 pricing tiers available.

Network – Free

- Unlimited transactions and connected wallet addresses

- DeFi and NFT Tax engine included

- Integration with 500+ platforms

Basic – $50 USD/year

- Unlimited transactions

- Live web chat support

- Provides historical tax forms and current-year tax forms for other platforms

Plus+ – $175 USD/year

- Unlimited transactions

- Live web chat support

- Tax optimization and Tax-Loss Harvesting tool included

- NFT Suite included

Pro – $500 USD/year

- Unlimited transactions

- Dedicated concierge and live web chat support

- Full integration and all forms available

- CPA Review and IRS Audit Support included

What is Crypto Tax Software?

The purpose of Crypto Tax Software is to easily let you connect your wallet or exchange so that you can provide the necessary forms when filing taxes. This software will import your assets, auto-fill the correct forms and more. Some of them will even apply your countries crypto tax laws to the amounts just to make sure everything is done correctly.

As you can see from above, there are quite a few different crypto tax software’s available to use when it comes time to filing your taxes. A lot of people might not realize that you have to claim your cryptocurrency at tax time. If you are someone that completes a lot of transactions throughout the year, you will need to file this with your taxes.

Let us know if you have used any of the above Crypto Tax Software and how it worked for you!

bx3kz6

2ujlz6